tax forgiveness credit pa

TurboTax indicates that we are eligible for the PA Special Tax Forgiveness Credit for 2021. Owe IRS 10K-110K Back Taxes Check Eligibility.

Pennsylvania Student Loan Forgiveness Programs

Owe IRS 10K-110K Back Taxes Check Eligibility.

. 2 Weeks Ago Pennsylvania. However we also received 40k in Social. Ad Compare the Best Tax Relief Companies to Help You Get Out of Tax Debt.

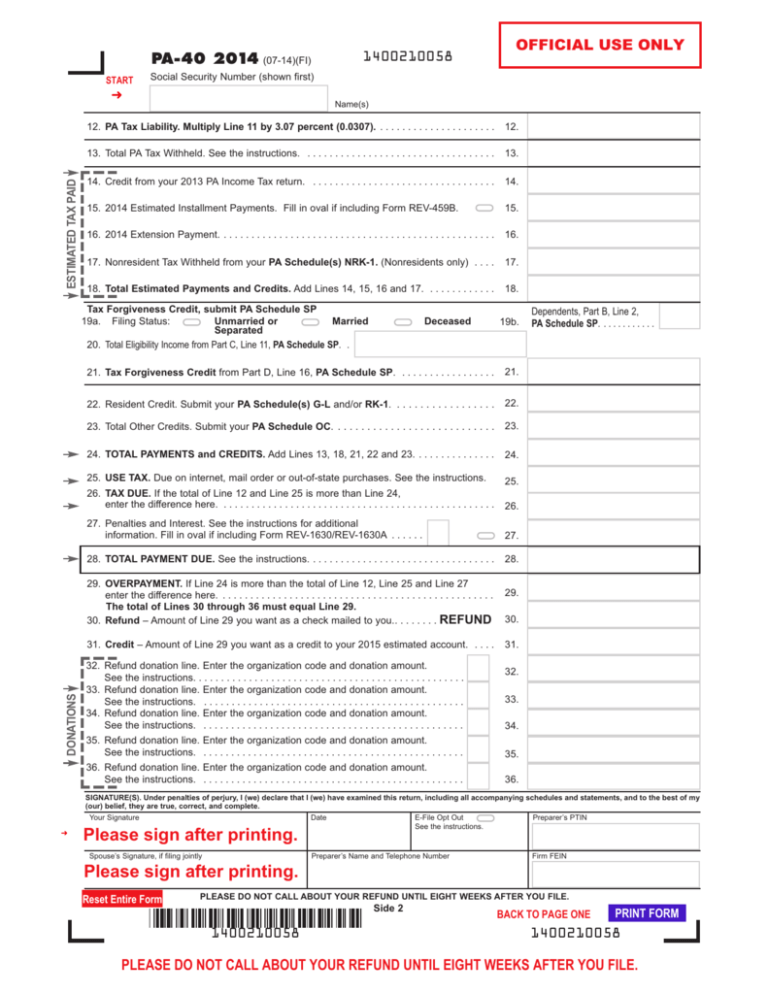

You andor your spouse are liable for Pennsylvania tax on your income. For taxpayers who earn a wage the employee. To claim this credit it is necessary that a taxpayer file a PA-40.

Record the your PA tax liability from Line 12 of your PA-40. You are subject to Pennsylvania personal income tax. Ad Owe back tax 10K-200K.

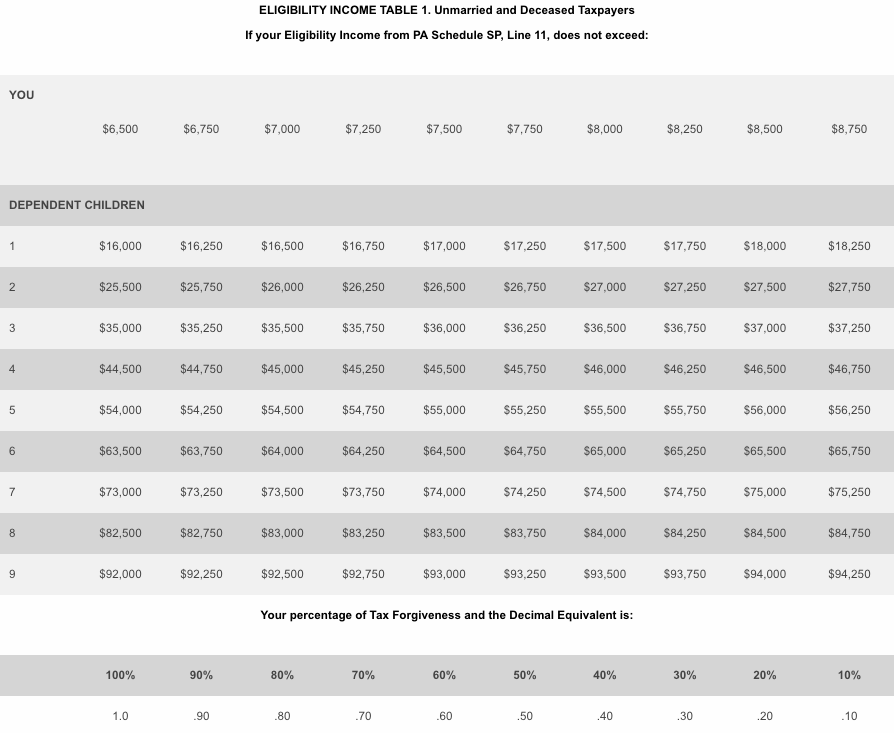

Report for the United Way of Pennsylvania. Unmarried and Deceased Taxpayers. PA - Special Tax Forgiveness Credit.

Alimony- Alimony payments that you received are not taxable in the state of Pennsylvania. Under Tax Authority or States go to the Pennsylvania Credits worksheet. At the bottom of that column is the percentage of Tax Forgiveness for which you qualify.

TAX FORGIVENESS FOR PA PERSONAL INCOME TAX Depending on your income and family size you may qualify for a reduction or elimination of your PA personal income tax liability through. Depending on your income and family size you may qualify for a refund or reduction of your Pennsylvania income tax liability with the states Tax Forgiveness program. See if you Qualify for IRS Fresh Start Request Online.

You can go to. State Tax Forgiveness. The Pennsylvania Tax Forgiveness Credit helps eligible PA taxpayers reduce their tax liability.

Form PA-40 SP requires. See if you Qualify for IRS Fresh Start Request Online. The Pennsylvania Tax Forgiveness Credit is a credit that allows eligible taxpayers to reduce all or part of their tax liability to PA.

Record tax paid to other states or countries. You can receive a Pennsylvania Tax Forgiveness Credit for up to 100 of your income tax on PA-40 Line 12. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems.

I think my client qualifies for the PA special tax forgiveness credit but Schedule SP is not being produced. What is Pennsylvania REV 419 ex. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability.

Ad Owe back tax 10K-200K. T 1 513 345 4540. The Tax Forgiveness program allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability.

However any alimony received will be used to calculate your PA Tax Forgiveness credit. You can receive a Pennsylvania Tax Forgiveness Credit for up to 100 of your income tax on PA- 40 Line 12. For example in Pennsylvania a.

Use PA-40 Schedule SP to claim the Tax Forgiveness Credit for taxpayers who meet the qualifications to reduce all or a part of their Pennsylvania Tax Liability. 5 2021 Pennsylvania enacted Act 1 of 2021 Act 1 specifically excluding forgiven Paycheck. The PA earned income was 9100.

IRS Tax Resolution Programs 2022 Top Brands Comparison Online Offers. The federal earned income tax credit or EITC is one of. Tax forgiveness gives a state tax refund to some taxpayers and forgives some taxpayers of their liabilities even if they havent paid their Pennsylvania income tax.

Ad Use our tax forgiveness calculator to estimate potential relief available. These standards vary from state to state. The IRS debt forgiveness.

Tax Forgiveness is a credit against PA tax that allows eligible taxpayers to reduce all or part of their PA tax liability. Ad Use our tax forgiveness calculator to estimate potential relief available. ELIGIBILITY INCOME TABLE 1.

If your Eligibility Income. To claim this credit it is necessary that you complete PA Schedule SP. Calculating your tax forgiveness credit 12.

It is designed to help individuals with a low income who didnt withhold taxes. IRS Tax Resolution Programs 2022 Top Brands Comparison Online Offers. The qualifications for the Tax Forgiveness Credit are as follows.

T 1 312 302 8617. Its for lower-income families and some single filers and is based on your income amount and size. What is tax forgiveness program.

States also offer tax forgiveness based on personal income standards. In Part D calculate the amount of your Tax Forgiveness. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems.

Ad Compare the Best Tax Relief Companies to Help You Get Out of Tax Debt. Provides a reduction in tax liability and. Form PA-40 SP requires you to list multiple forms of income.

Am I Eligible For Public Service Loan Forgiveness Savingforcollege Com

Low Income Pennsylvanians May Be Missing Out On Pa Tax Refunds Of 100 Or More

Rhode Island Ppp Loan Forgiveness Income Tax Assessments Marcum Llp Accountants And Advisors

Irs Tax Debt Relief Forgiveness On Taxes

Tax Faqs When Can You Use Irs One Time Forgiveness Geaux Tax Resolutions

Testamentary Capacity Youtube Youtube Capacity

500 Million Flaming Salute Join Zippo June 5th On Facebook For Up To Date Infor Credit Card Debt Forgiveness Private Mortgage Lenders Debt Consolidation Loans

Public Service Loan Forgiveness Do You Qualify For It Student Loan Hero

Map Credit Kinder Morgan This Map Shows The Various Pipelines Owned By Kinder Morgan Kinder Morgan The Province The Expanse

Can You Rely On Public Service Loan Forgiveness District Capital

Tampa Tax Attorney Discusses Irs Offer In Compromise Oic Debt Relief Programs Offer In Compromise Tax Attorney

Pennsylvania Special Tax Forgiveness Credit Do You Qualify Supermoney

Late 1700 S Early 1800 S Shot Pouch With Horn Amp Accoutrements Pouch Life Pictures Horns

Can You Apply For Teacher Loan Forgiveness Twice No But Student Loan Hero

21 Ways To Forgive Plus 9 Reasons We Must Forgive Wes Daughenbaugh 9781683140719 Amazon Com Books

Pennsylvania Special Tax Forgiveness Credit Do You Qualify Supermoney